Please see below Frequently Asked Questions (FAQs) that we are often asked at ClickSuper. If your question is not answered below please email the ClickSuper Client Service Team at support@clicksuper.com.au and we will be happy to help.

For FAQs for Electronic Service Addresses for SMSFs please see the following page: https://www.clicksuper.com.au/self-managed-super-fund/

ClickSuper Registration

I WANT TO REGISTER TO USE CLICKSUPER. WHAT DO I DO?

Registering to use ClickSuper is easy. You can register by going to our website at www.clicksuper.com.au and then by clicking the Apply Now button and filling in the online form.

To apply as an employer you will need an code to identify which payroll software you use. Please note that if you do not have your code please contact your Payroll Provider or contact our ClickSuper Client Service Team via LIVE Chat here: https://www.clicksuper.com.au/chat-support/ or via email at support@clicksuper.com.au.

WHAT IS MY PAYROLL CODE?

To apply as an employer you will need an code to identify which payroll software you use. Please note that if you do not have your code please contact your Payroll Provider or contact our ClickSuper Client Service Team via LIVE Chat here: https://www.clicksuper.com.au/chat-support/ or via email at support@clicksuper.com.au.

A SMSF registering for an ESA does not have a payroll code – please click see https://clickstream.p.vu/RegisterSmsf for the correct registration form.

HOW LONG WILL IT TAKE TO COMPLETE THE REGISTRATION PROCESS?

There are three steps to complete the registration process.

The first step is completed simply by clicking the Apply Now button and entering in preliminary details to get started.

An email is then sent to the email address provided which contains a link to enter further information (such as bank account to debit super from and an Officeholder/s to verify the details provided). Once this step is completed a third and final email will be sent to the Officeholder/s to simply verify the details provided and once verified the account is ready to go.

WHAT IS A BRANCH NAME?

A branch name is used by clients who use the same ABN for a number of divisions or entities within their organisation but need to pay superannuation from different bank accounts. If a client only has one bank account to pay superannuation from for their organisation the branch name should be left blank.

WHAT IS A SYSTEM ADMINISTRATOR?

A System Administrator is the main contact for the account in which if needed, will be the first point of contact and receive notifications relating to your organisation.

WHAT IS AN OFFICEHOLDER?

An Officeholder is a director or an individual in your company that is a signatory of the bank account ClickSuper will debit superannuation from on behalf of your organisation. If an Officeholder verifies the details provided in the registration process this authorises ClickSuper to debit superannuation from the bank account listed.

I HAVE BEEN ADVISED BY MY PAYROLL PROVIDER THAT I NEED A USERNAME AND PASSWORD TO ENTER INTO MY PAYROLL SOFTWARE. WHAT DO I DO?

Special login credentials to enter into your payroll software will be sent via email once the account has completed the registration process. However if you cannot locate these details please contact the ClickSuper Client Service Team at support@clicksuper.com.au with the name and ABN of your organisation and we are happy to help.

WHY DOES CLICKSUPER NEED MY ORGANISATION’S BANK ACCOUNT?

ClickSuper direct debits all superannuation based on the superannuation data file uploaded to ClickSuper. It is in this manner that we minimise human error through the risk of typos and ensure that money matches the data. We do not currently accept EFT or credit card payments.

I HAVE REGISTERED TO USE CLICKSUPER BUT DO NOT KNOW IF MY FACILITY IS READY TO OPERATE?

When we activate your new ClickSuper facility we will send an email to the registered users confirming activation.

If you did not receive an activation email or are unsure what to do next please contact the ClickSuper Client Service Team on support@clicksuper.com.au, in order to assist us, please have the name and ABN of your registration ready in your email.

WHERE CAN I OBTAIN THE CLICKSUPER PRIVACY POLICY

ClickSuper Pty Limited (‘ClickSuper’) recognises an individual’s right to privacy and understands that protection and confidentiality of personal information is important. You can find our privacy policy here: https://www.clicksuper.com.au/privacy/

WHERE CAN I OBTAIN THE CLICKSUPER PDS?

The PDS is provided during the third step of the registration process to the Officeholder/s can download and review the PDS before verifying and finalising the registration of an organisation.

After registration is completed, you can download a copy of your PDS by logging into your ClickSuper account, visiting the MY ORGANISATION menu, then the BRANCHES menu and click EDIT. Your PDS link will be displayed in the DETAILS section and can be downloaded by clicking the word PDS.

HOW MUCH DOES CLICKSUPER COST TO USE?

There are different costs for using ClickSuper depending on the level of integration with a client’s payroll software provider, the number of employees being paid for and the frequency of payment. Please email the ClickSuper Client Service Team at support@clicksuper.com.au for confirmation of cost and we are happy to confirm this for you.

WHAT IF I HAVE MADE A MISTAKE ON MY REGISTRATION?

Please contact the ClickSuper Client Service Team at support@clicksuper.com.au with the name and ABN of your registration and we are happy to help.

Getting started with ClickSuper

HOW DO I LOG IN TO CLICKSUPER?

Please go to the LOGIN page by clicking the LOGIN menu option in the top right hand corner or by clicking the following link:

https://clickstream.p.vu/Authentication/Login?ReturnUrl=%2F

HOW DO I LOG OUT OF CLICKSUPER?

Please click your name in the top right hand corner. In the dropdown menu that will appear, please click the Log Out option to log out. Alternatively, clicking the below link will also log out of an account:

https://clickstream.p.vu/Authentication/Logout

I HAVE FORGOTTEN MY PASSWORD – HOW DO I RESET MY PASSWORD?

If you need to reset your password please visit the following link:

https://clickstream.p.vu/Authentication/ForgotPassword

If you need further help with resetting your password please send an email to the ClickSuper Client Service Team at support@clicksuper.com.au containing your username and ABN of your organisation.

I HAVE FORGOTTEN MY USERNAME – HOW CAN I FIND OUT WHAT IT IS?

Please contact the ClickSuper Client Service Team at support@clicksuper.com.au with the name and ABN of your registration and we are happy to help.

THE PREVIOUS CONTACT FOR OUR ORGANISATION HAS LEFT AND I NOW NEED TO BE ADDED TO ACCESS OUR ACCOUNT. WHAT DO I NEED TO DO?

Please contact the ClickSuper Client Service Team at support@clicksuper.com.au with the name and ABN of your registration and we are happy to help.

HOW DO I KNOW WHAT ABN AND USI TO USE FOR SUPERANNUATION FUNDS IN CLICKSUPER?

ClickSuper has an extensive database updated daily from the Australian Taxation Office that lists all the Superannuation Fund ABNs in Australia, including SMSFs (self-managed superannuation funds). A unique superannuation identifier (USI) is a series of letters and/or numbers that identify a super fund or a particular super product it offers and tells ClickSuper exactly where a contribution needs to be paid to for an employee. ClickSuper cannot make a payment for an employee without being provided the ABN and USI for the appropriate superfund.

To search our superfund list please log in to ClickSuper and use our Search function. For a guide to searching our superfund list please see our help guide which explains this process:

HOW DO I UPLOAD MY SUPERANNUATION FILE TO CLICKSUPER?

If you use a payroll software provider it is best to confirm with them directly as many of our payroll partners have a direct method to send superannuation files to ClickSuper, making it easy for clients to upload. If you export your superannuation file from your payroll software and need to manually upload it into ClickSuper please see the following link to our help guide which explains this process:

http://portal.paymentadviser.com.au/display/CSUG/Uploads#Uploads-UploadAFile

HOW DO I TELL CLICKSUPER WHAT BANK ACCOUNT TO PAY SUPERANNUATION TO?

ClickSuper obtains bank account information to pay contributions to for every APRA-regulated superannuation fund in Australia so clients do not need to advise the bank details for these superfunds. The only instance where we require bank account information is for SMSFs – employers need to provide this detail when uploading their superannuation data to ClickSuper.

I DO NOT KNOW THE MEMBER NUMBER FOR AN EMPLOYEE, CAN I STILL PAY THEIR SUPERANNUATION?

If a member number is not provided ClickSuper can still process a contribution for an employee but will need the Tax File Number to be included instead so the superfund can locate and process a payment to the correct member account. Once obtained, the member number should be added to future contribution payments.

Using ClickSuper

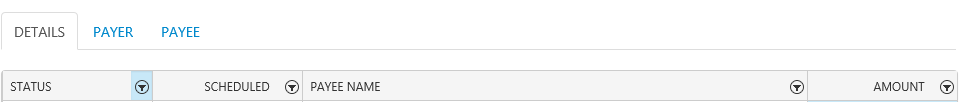

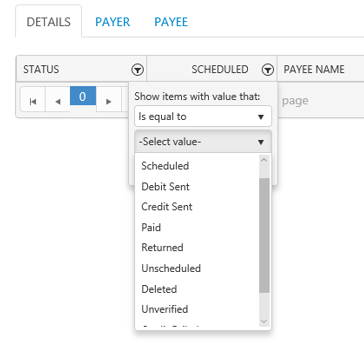

I AM ON THE PAYMENTS PAGE IN CLICKSUPER AND CAN NO LONGER SEE MY PAYMENTS?

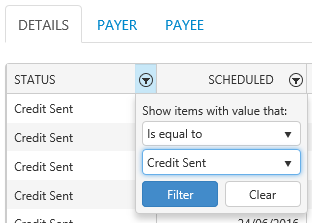

It is likely that your payments have moved to a different status in ClickSuper. Payments in ClickSuper will move though the payment “Statuses”. Please note the drop down menu, will allow you to filter between different status types. This drop down menu is located in the top left hand corner of your Payments page, as shown below:

By clicking on the drop down menu, you will see the following status options:

By going through each of these statuses you will be able to locate your payments, view remittance advices sent to superannuation funds and identify if a superannuation fund has downloaded a remittance advice for a particular payment.

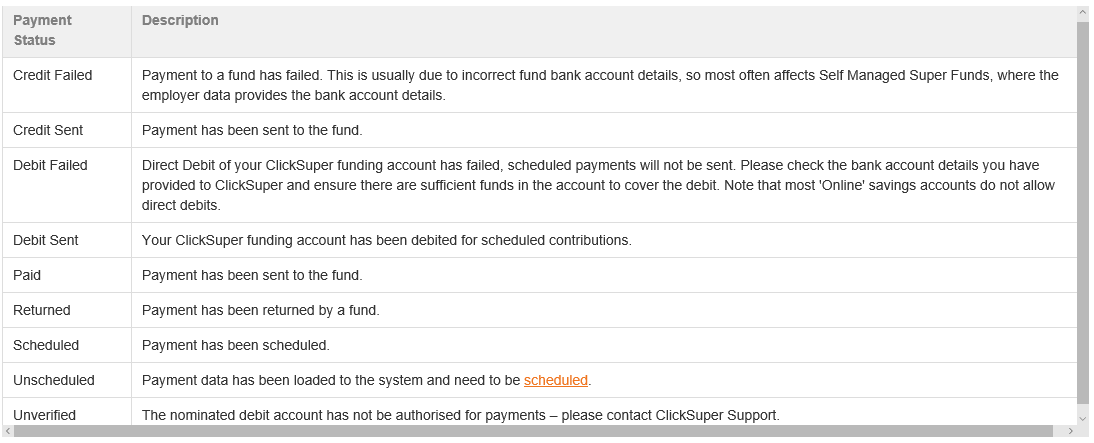

WHAT DOES A STATUS FOR A PAYMENT MEAN?

Each payment in ClickSuper will have a status which is used to determine what stage of the payment process a given payment is up to. Please refer to the table below for a list of the different statuses and their definitions:

I HAVE A DEFAULT FUND, HOW DO I TELL CLICKSUPER WHAT MY DEFAULT FUND IS?

A default fund is the superfund you pay your employee’s super guarantee contributions into if they don’t have a membership with a fund or do not provide a superfund to their employer. It must offer a MySuper option and a minimum level of life insurance. Larger companies often have more than one default fund.

ClickSuper will automatically notify default fund(s) of any changes to member information (e.g. member address) and for new members will send a registration message with their first contribution.

Clients can note their default fund on their account by logging in to ClickSuper, clicking on the MY ORGANISATION menu option on the left hand side and then clicking on the Default Funds tab. Clicking on the link Add another will allow clients to enter in their default fund.

HOW DO I CHANGE THE BANK ACCOUNT LISTED FOR MY ORGANISATION?

To view or change bank details, simply log in to ClickSuper and click the “MY ORGANISATION” menu on the left hand side of the page. Then click the Branches tab and click the edit button.

The banking details will be displayed on this page and can be updated accordingly. If changes are made, an email will be sent to the listed Officeholders on the account for them to verify the changes made – if it isn’t verified within 10 days the account will deactivated, so it is important that verification of the changes made occur as soon as possible.

I UPLOADED A SUPERANNUATION FILE BUT IT FAILED. WHY DID IT FAIL?

ClickSuper can only process superannuation files that can be processed through Superstream – if there is a problem with the data within ClickSuper will fail the file and provide an error report so clients can view why the failure occurred.

To view the error report please log in to ClickSuper, click on the UPLOADS menu option and the highlight the failed superannuation file. Once highlighted, a button will appear at the bottom of the page called ERRORS – please click this button to view the error report.

HOW LONG DOES IT TAKE FOR SUPERANNUATION TO BE PAID TO THE SUPERANNUATION FUNDS?

In Australia all direct debited payments take 3 business days to clear. To ensure that we only send cleared monies to the superfund, ClickSuper will wait 3 business days before making payment. For more information please see the below diagram from our help guide explaining our Direct Debit Payment Schedule:

http://portal.paymentadviser.com.au/display/CSUG/Direct+Debit+Payment+Schedule

I HAVE RECEIVED A DEBIT FAILURE NOTIFICATION. WHAT DOES THIS MEAN?

A debit failure occurs when ClickSuper attempts to debit a superannuation payment from your organisation’s registered bank account but it has failed. This can be due to lack of funds or a closed account as the most common of reasons.

Clients can check the bank account registered for their organisation by logging in to ClickSuper and then clicking the MY ORGANISATION” menu option. From here, please click the Branches tab and then click the edit button. The banking details will be displayed on this page and can be updated accordingly. If changes are made, an email will be sent to the listed Officeholders on the account for them to verify the changes made – if it isn’t verified within 10 days the account will deactivated, so it is important that verification of the changes made occur as soon as possible.

Once the reason for the debit failure has been sorted the payments need to be re-scheduled for debit. To re-schedule a payment please see the following guide or contact the ClickSuper Client Service Team at support@clicksuper.com.au

I HAVE RECEIVED A CREDIT FAILURE NOTIFICATION. WHAT DOES THIS MEAN?

A credit failure can occur when the bank account ClickSuper is provided to pay a contribution to for a SMSF has failed – usually due to a closed or incorrect bank account. The appropriate employee in question should be contacted to obtain correct bank details and then the contribution needs to be uploaded again with the new banking details.

When a credit failure occurs the monies for the contribution bounce back to the employer.

HOW DO I AUTHORISE PAYMENTS TO BE PAID IN CLICKSUPER?

In ClickSuper we call the process of authorising ‘scheduling’ in which clients can schedule a date that contributions are debited. Some clients have automatic scheduling so this won’t apply, however for a guide to scheduling please see the below link from our help guide:

http://portal.paymentadviser.com.au/display/CSUG/Payments#Payments-SchedulePayments

MY PAYMENTS ARE UNVERIFIED – WHAT IS WRONG?

This scenario occurs if an organisation has not completed the registration process and so is not authorised to process payments yet or an update occurred to the account which was not verified by the Officeholder. Please contact ClickSuper Client Service Team at support@clicksuper.com.au for help.

Refunds

I HAVE RECEIVED A REFUND. WHAT SHOULD I DO NOW?

The reason why the refund has occurred should be investigated. The most common reasons for refunds are that employees have changed superannuation funds but have yet to advise their employers. Clients should liaise with the appropriate employee to confirm any new superannuation fund details.

If ClickSuper has received a reason from the superfund why a refund has been occurred, it will be sent as a contribution error. A contribution error isn’t necessarily related to a refund but they can be so should always be viewed. ClickSuper notifies clients via email when a contribution error has been received on behalf of their organisation. For a guide on viewing a contribution error please see the following guide:

http://portal.paymentadviser.com.au/display/CSUG/New+Contribution+Error+Message

HOW DO I REPAY A REFUND?

The standard process is to upload a new superannuation file from your payroll software provider. Majority of providers have developed easy processes for their clients to upload new superannuation files or submit payment adjustments through payroll. If your payroll software provider does not have a facility in place to repay refunded superannuation please send us an email to ClickSuper Client Service Team at support@clicksuper.com.au for help.

I HAVE RECEIVED A PAYMENT FROM CLICKSUPER BUT I DON’T KNOW WHAT IT IS FOR?

If it is a refund, a refund email should have been sent to the main notification email listed on your account. Please contact ClickSuper Client Service Team at support@clicksuper.com.au confirming the payment reference on your bank statement, the amount received and the date received and we are happy to help.

A SUPERFUND HAS SAID THEY REFUNDED A PAYMENT FOR MY ORGANISATION BUT I HAVEN’T RECEIVED IT YET. WHAT SHOULD I DO?

Please contact ClickSuper Client Service Team at support@clicksuper.com.au confirming the date of refund, amount of refund and bank account monies were refunded to at ClickSuper and we are happy to investigate further.